For banks, End-of-Day (EOD) batch processing is the heartbeat of operational continuity and regulatory compliance.

Each night, millions of transactions must be:

Reconciled across payment, core banking, and treasury systems

Settled across internal and interbank ledgers

Posted to customer accounts and general ledgers

Rolled into daily compliance and MIS reporting

This entire cycle must complete before Beginning-of-Day (BOD) to allow a clean operational start.

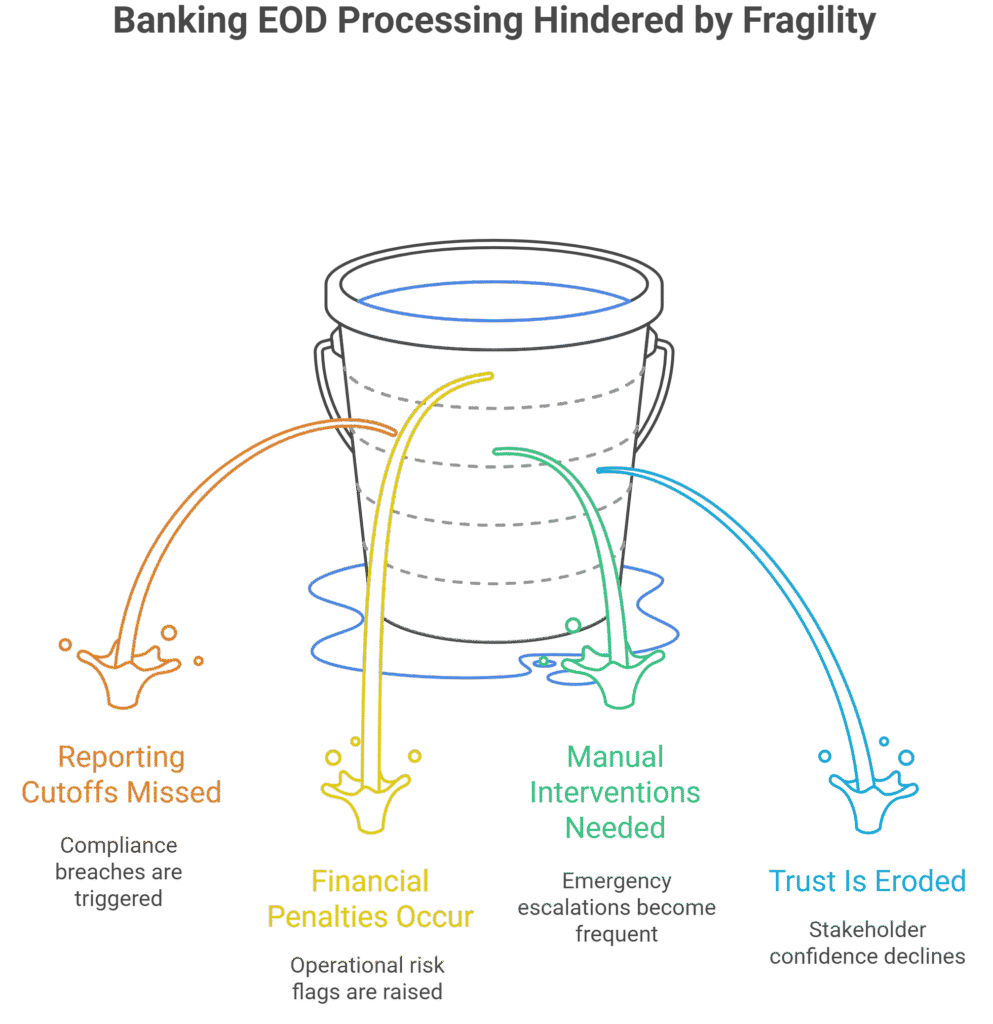

Even minor delays can trigger:

Missed regulatory reporting cutoffs and compliance breaches

Financial penalties and operational risk flags

Costly manual interventions and emergency escalations

Erosion of trust with regulators, auditors, and customers

While banks invest heavily in EOD functional logic, infrastructure fragility is often the hidden cause of failure — an area most traditional monitoring overlooks.

In a leading retail bank, EOD batch cycles began consistently overrunning the available overnight window. Business logic was sound, yet:

Application servers intermittently went offline during batch execution

Middleware nodes became saturated under concurrent job loads

Database storage showed latency spikes during ledger reconciliation

Alert noise from multiple tools made it hard to isolate the root cause

These infrastructure slowdowns consumed critical time buffers, pushing batch completion dangerously close to BOD, risking compliance violations and downstream settlement failures.

The bank needed a resilient, self-healing infrastructure layer to protect the EOD window.

QPH deployed its flagship IntelliPulse HUB (IPH) to fortify the bank’s infrastructure foundation for EOD cycles.

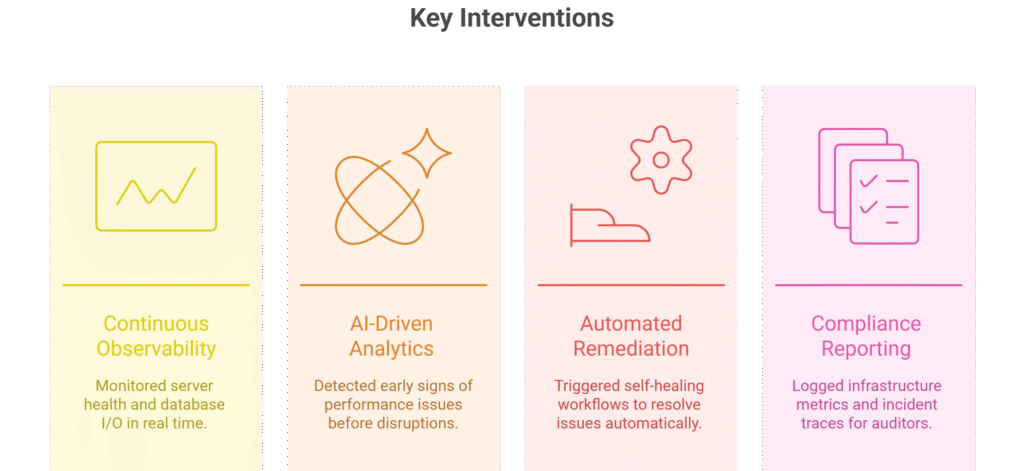

Key interventions included:

AI-Driven Performance Analytics

Detected early signs of CPU contention, memory leaks, and storage lag before they disrupted batch schedules.

Automated Remediation Playbooks

Triggered self-healing workflows to restart failed nodes, clear resource locks, and rebalance loads without manual intervention.

Compliance-Ready Reporting

Logged full infrastructure availability metrics and incident traces to provide auditors verifiable assurance of EOD stability.

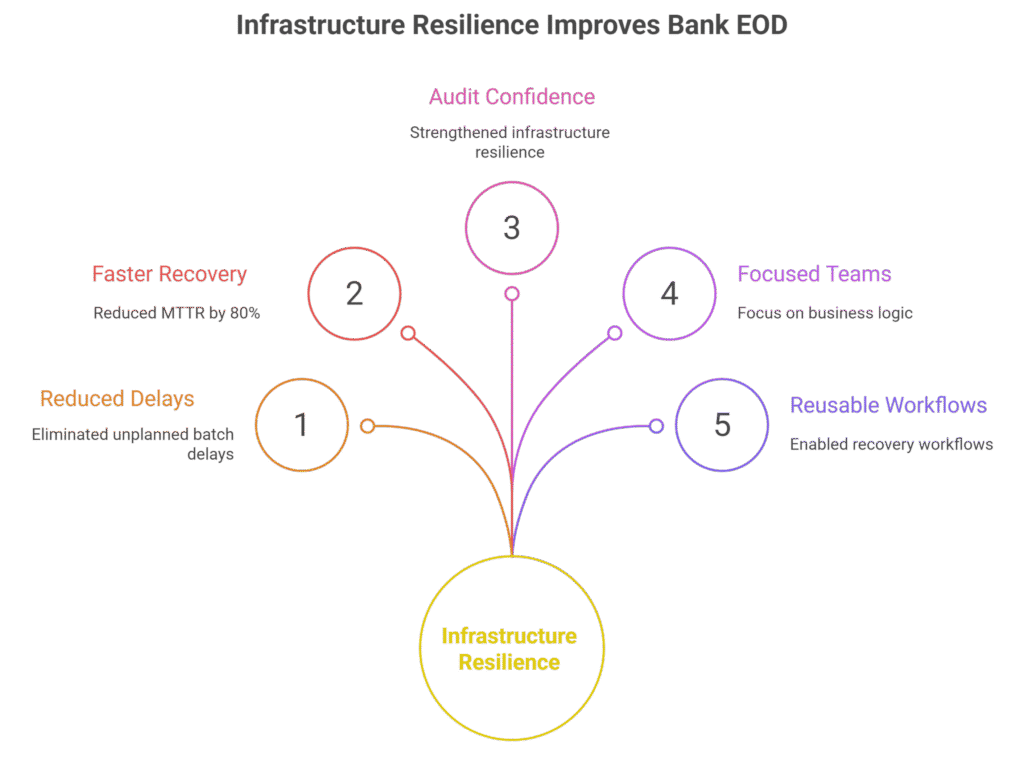

Within weeks, the bank shifted from nightly firefighting to predictable, resilient EOD completion:

Eliminated unplanned infrastructure-related batch delays

Reduced mean time to recover (MTTR) for system incidents by 80%

Strengthened audit confidence in infrastructure resilience

Freed operations teams to focus on business logic, not platform stability

Enabled reusable recovery workflows for future EOD cycles

This transformation gave the bank confidence that EOD delays will never stem from infrastructure failures, even during high-volume month-end or quarter-end loads.