Banking applications are the operational backbone of digital financial services.

They handle millions of daily interactions across:

Mobile banking and internet portals

Real-time payment gateways

Loan origination and approval systems

Credit/debit card transaction platforms

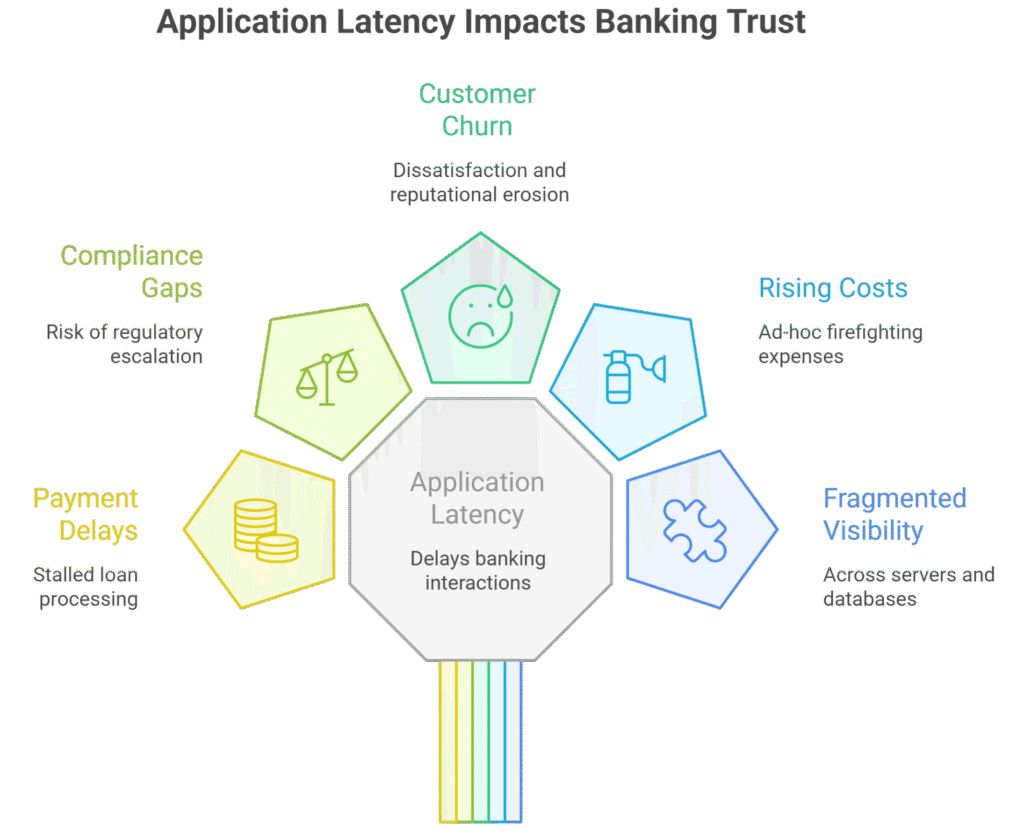

In this always-on ecosystem, performance is inseparable from trust. Even small delays can cascade into:

Delayed payments, stalled loan processing, and SLA breaches

Compliance reporting gaps and risk of regulatory escalation

Customer dissatisfaction, churn, and reputational erosion

Rising operational costs from ad-hoc firefighting

Fragmented visibility across servers, middleware, and databases

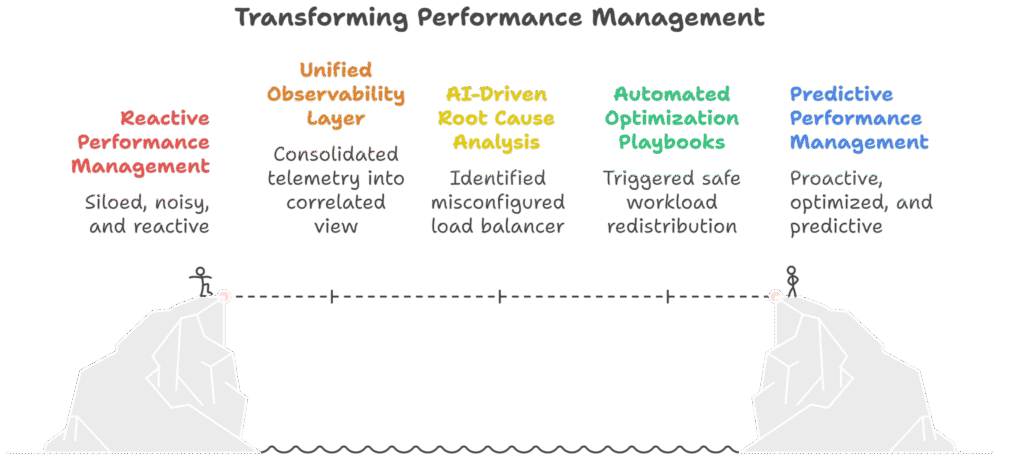

Traditional monitoring tools flag symptoms (CPU spikes, queue build-ups, slow API calls) but fail to correlate signals across the full stack. This leaves IT teams trapped in reactive troubleshooting and unable to prevent customer-facing performance issues before they escalate.

At a leading financial institution, the application servers that process high-volume customer transactions began experiencing severe latency during peak usage hours.

Response times slowed from milliseconds to several seconds

Customer transactions queued and timed out

Downstream settlement and reporting processes slipped past cutoffs

Compliance teams flagged delayed reports and potential SLA penalties

Monitoring tools showed scattered red flags but no clear root cause

Although systems stayed online, the degraded performance eroded customer trust and risked regulatory scrutiny — all while draining support teams in constant firefighting mode.

QPH deployed its flagship IntelliPulse HUB (IPH) to transform the bank’s performance management approach from reactive to predictive.

Key interventions included:

AI-Driven Root Cause Analysis

Identified a misconfigured load balancer that was routing requests unevenly and overloading certain nodes.

Automated Optimization Playbooks

Triggered safe workload redistribution workflows to dynamically rebalance traffic across clusters, restoring normal response times instantly.

Predictive Analytics Engine

Continuously learns performance baselines and pre-flags future bottleneck risks before they impact customers.

Within hours, the bank’s application response times stabilized and customer transaction flow returned to normal.

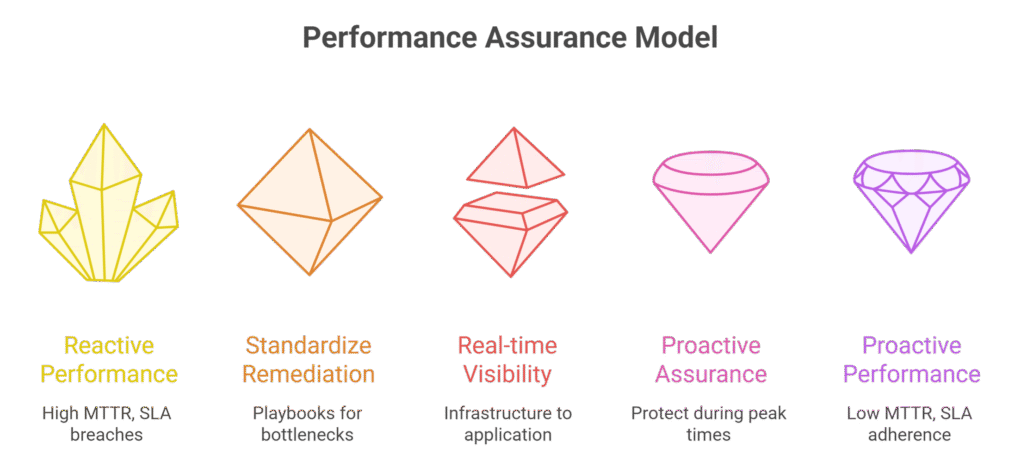

More importantly, the institution gained a repeatable and proactive performance assurance model:

70% reduction in Mean Time to Resolution (MTTR) for performance incidents

Dramatic drop in SLA breaches and customer complaints

Standardized remediation playbooks for future bottlenecks

Real-time visibility from infrastructure to application layer

Improved operational resilience and audit readiness ratings

The performance assurance framework now protects critical banking apps during high-volume peaks such as salary disbursal days, quarter-end settlement windows, and loan campaign launches — eliminating customer-impacting slowdowns.