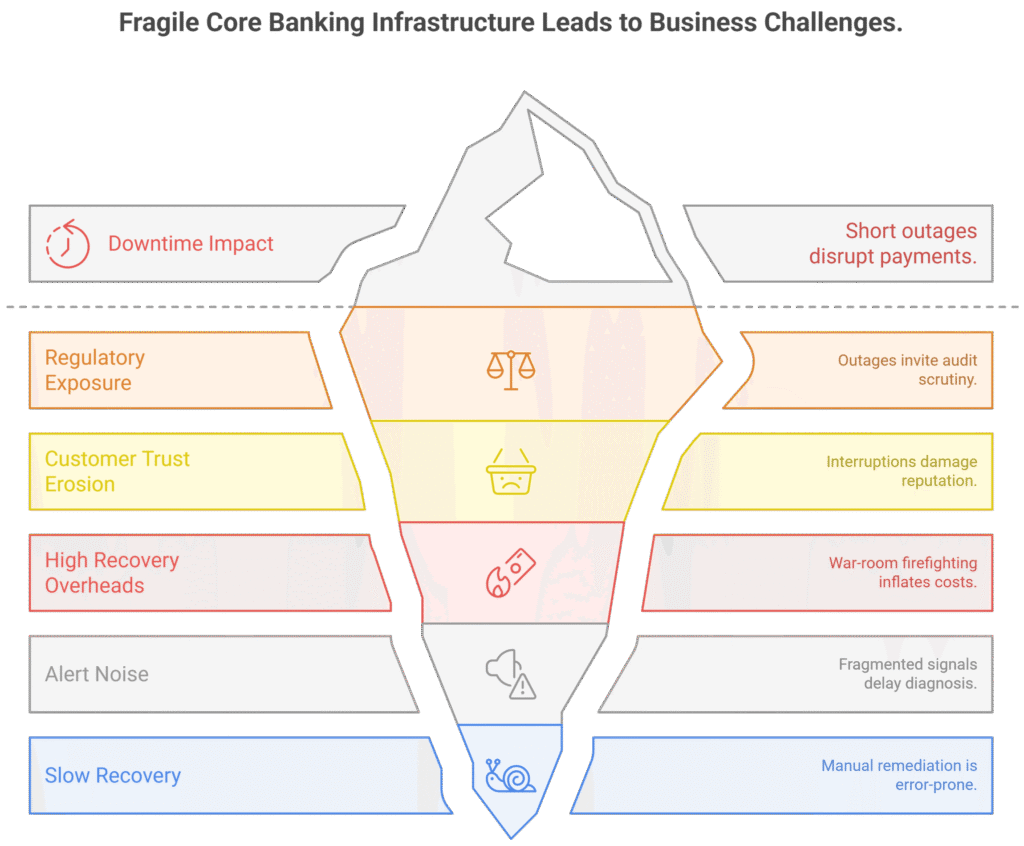

The Business Challenge — Fragile Core Banking Infrastructure

Core banking platforms process millions of daily transactions — from ATM withdrawals and real-time payments to end-of-day settlement batches.

But in high-volume environments, even a minor infrastructure fault can trigger costly disruptions.

Current Pain Points:

Downtime Impact: Even short outages disrupt payments, delay settlements, and breach SLAs.

Regulatory Exposure: Outages invite audit scrutiny, compliance penalties, and risk flags.

Customer Trust Erosion: Interruptions damage reputation and drive attrition.

High Recovery Overheads: War-room firefighting inflates operational costs.

Alert Noise, No Root Cause: Siloed monitoring tools flood teams with fragmented signals, delaying diagnosis.

Slow, Manual Recovery: Human-led remediation is error-prone and unfit for always-on banking.

Banks need a self-reliant remediation layer that can detect, isolate, and resolve incidents in real time — before they impact customers or regulators.

Real-World Scenario — When Banking Comes to a Standstill

A leading commercial bank experienced this during peak hours:

Transaction switch nodes started failing intermittently under load

Multiple tools triggered thousands of uncorrelated alerts

NOC and L2 teams were overwhelmed, delaying triage

Customer transactions timed out, settlement queues grew

Compliance teams flagged SLA breaches and risk escalation

With no clear root cause and no automated fallback, every minute of downtime risked millions in lost revenue and reputational damage.

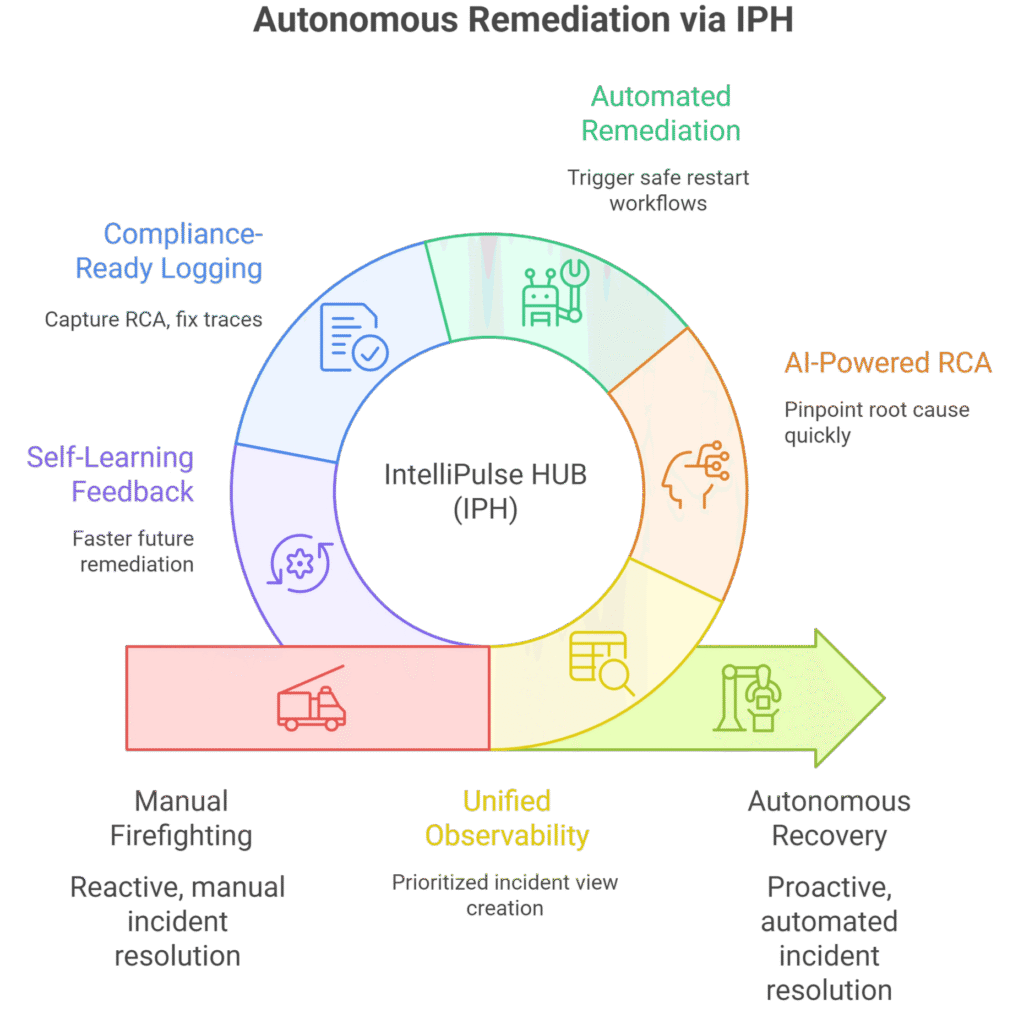

The QPH Approach — Autonomous Remediation via IPH

QPH deployed its flagship IntelliPulse HUB (IPH) to build a self-healing infrastructure fabric around the bank’s core payment systems.

Key Capabilities Delivered:

Unified Observability: Correlated thousands of noisy alerts into a single, prioritized incident view

AI-Powered Root Cause Analysis: Pinpointed a misconfigured middleware node within minutes

Automated Remediation Playbooks: Triggered safe restart and cluster rebalance workflows without human intervention

Compliance-Ready Logging: Captured full RCA, fix traces, and audit logs for regulatory reporting

Self-Learning Feedback Loop: Fed incident learnings back into IPH’s knowledge graph for faster future remediation

This approach shifted the bank’s operations from manual firefighting to autonomous recovery.

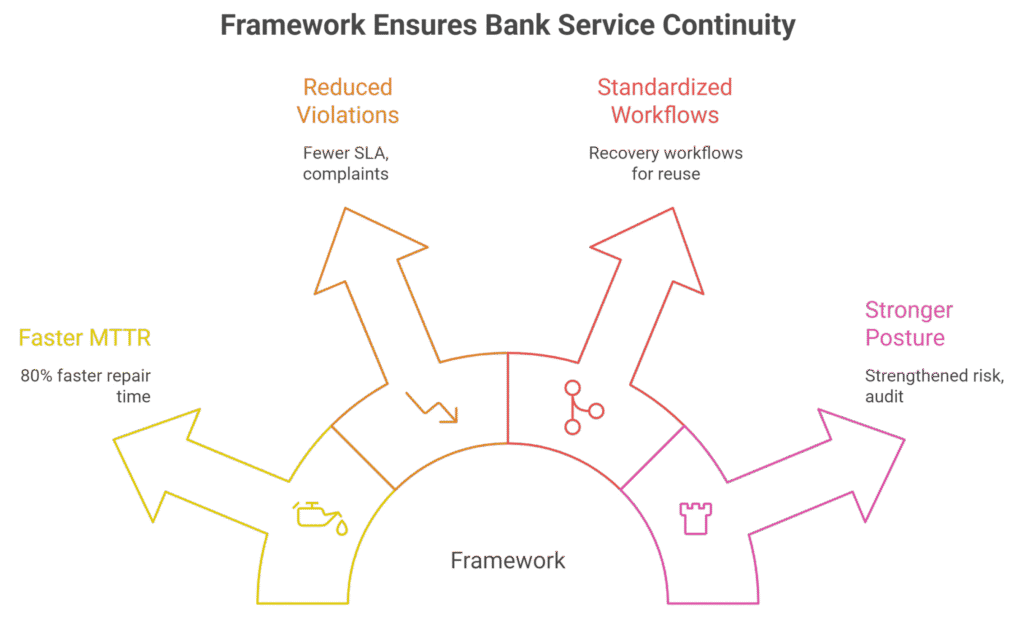

Business Outcomes — From Disruption to Continuity

Within minutes, the bank restored full service and avoided regulatory breach reporting.

Measurable Benefits:

80% faster Mean Time to Repair (MTTR) during the incident

Significant reduction in SLA violations and customer complaints

Standardized recovery workflows for future reuse

Strengthened operational risk posture and audit readiness

The same framework now protects EOD settlement, payment switches, and middleware clusters from future disruptions — ensuring continuity at scale.

Key Takeaway